A surprising statistic reveals that 68% of consumers prefer to order directly from restaurants instead of using third-party delivery apps like Zomato or Swiggy. Restaurant owners still prominently display Zomato Swiggy logos on their storefronts and menus, despite their customers’ preferences.

The financial reality becomes clear as we get into Zomato’s business model. Third-party delivery platforms charge commissions ranging from 15% to 30% on each order, and these fees can reach up to 35%. A restaurant generating $1 million in annual third-party delivery sales could lose between $150,000 and $350,000 in commission fees, which directly affects their profit margins. A meal that brings 15% profit through in-house dining turns into a 7.6% loss after adding delivery app fees.

Direct ordering systems cost restaurants just $10,000-$20,000 annually, which saves them over $130,000 compared to third-party platforms. Price differences affect customers too. To cite an instance, restaurants need to increase a Rs 100 food item to Rs 140 on the application. This piece will help you understand the actual costs of using Zomato versus direct ordering systems, so you can make the right financial choice for your restaurant in 2025.

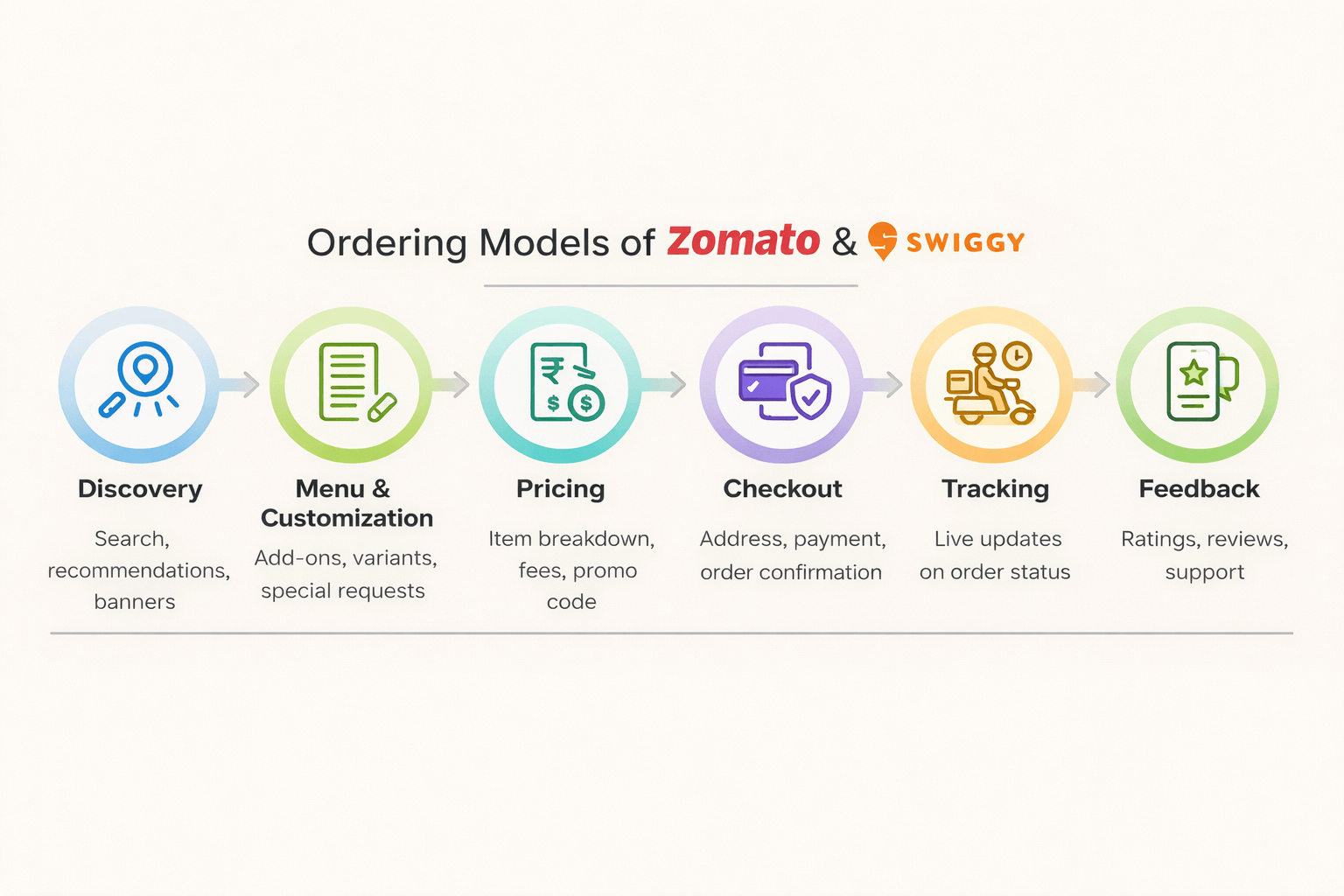

Understanding Zomato and Direct Ordering Models

The restaurant industry has seen a major change in how food businesses work online. Two main models have emerged as the top choices.

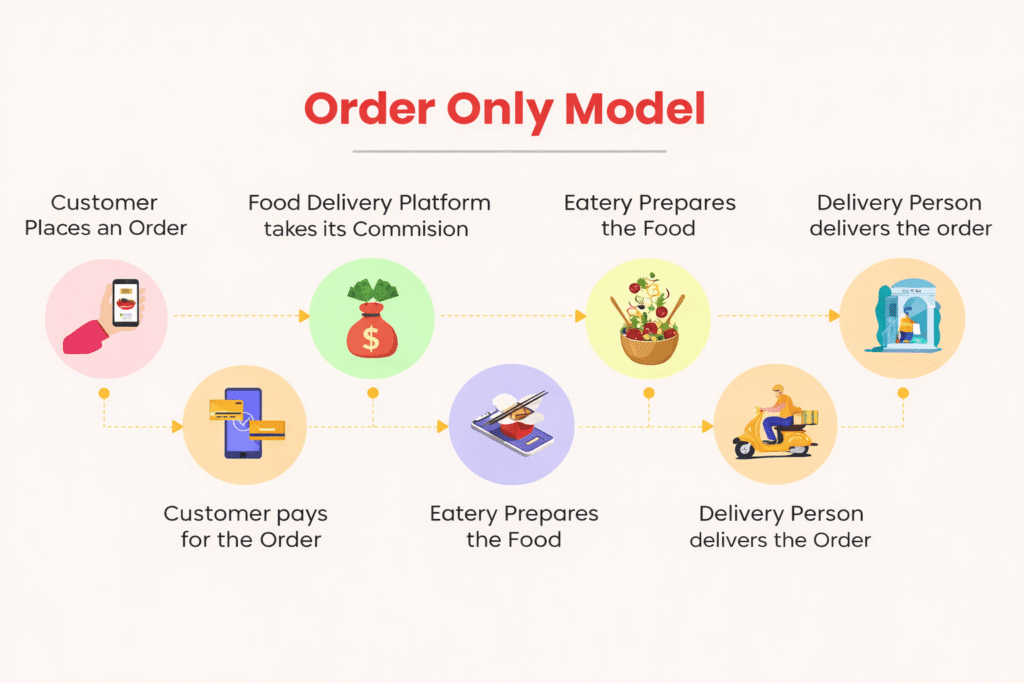

Zomato Business Model: Commission-Based Aggregator

Zomato works as a three-sided marketplace that connects millions of users with restaurants through delivery partners. The platform charges restaurants a commission on every order. These charges typically range from 15% to 30% of the order value, though some regions see rates between 5% to 7%.

Zomato makes money through several channels:

- Advertising and premium listings for restaurants

- Delivery charges paid by customers

- Subscription services like Zomato Pro

- Data and analytics services

Restaurants get a ready-made digital infrastructure and access to a large customer base with Zomato. But they give up control of customer data and pay much of each sale as commission.

What is Direct Ordering? Website, App, and QR Code Systems

Direct ordering systems let restaurants take online orders for pickup, delivery, and dine-in without middlemen. These systems include:

Direct ordering comes with zero commission fees, unlike aggregator models. Restaurants still pay processing charges for payments (2-4%, as with delivery apps).

These systems offer several ways to order. Customers can use the restaurant’s website, dedicated mobile app, or scan QR codes at tables. QR code systems have cut wait times by 50% and reduced menu printing costs by 30%.

Add a Restaurant on Zomato vs Building Your Own Platform

Joining Zomato needs no upfront investment—there are no registration or listing fees. Restaurants can quickly tap into Zomato’s large customer base, which processes 56 million orders in a single month. But each sale comes with those commission fees.

Building your own ordering platform costs money upfront but eliminates ongoing commissions. Many direct ordering providers offer free basic services and premium features at extra cost. Restaurants also get full control over their online presence, customer data, and ordering experience.

The contrast is clear: Zomato helps restaurants get immediate visibility, while direct ordering systems save money long-term and give more control over customer relationships. A restaurant’s choice ended up depending on its priorities—immediate reach or long-term profitability and independence.

Cost Breakdown: Zomato vs Direct Orders

Image Source: Actowiz Solutions

A look at the financial numbers shows a clear difference between third-party platforms and direct ordering solutions.

Commission Fees: 15-30% vs 0%

Restaurants pay their biggest expense through Zomato’s commission fees. These fees range from 15% to 30% on each order. On top of that, some restaurants pay up to 35% when all fees add up. Direct ordering systems don’t charge any commission, which lets restaurants keep almost all their earnings.

Service and Processing Charges: 2-4% on Both

Both systems come with payment processing fees. Zomato adds a service fee of 2-4% per transaction to cover credit card processing and customer support. Direct ordering systems need similar payment processing fees of 2-3% per transaction. This is one area where both options cost about the same.

Marketing Costs: Paid Promotions vs Owned Channels

Restaurants need to pay for premium spots to stand out on Zomato. Sponsored listings begin at ₹5-15 per click, with monthly budgets between ₹15,000-30,000. A homepage takeover costs more than ₹25,00,000 per day. Direct ordering platforms let restaurants market through their own channels like email, SMS, and social media at much lower costs.

Hidden Charges: Offer Listings, Delivery Disputes, and More

Other expenses cut into profits on delivery platforms:

- Platform fees from ₹2-14 per order

- Higher packaging fees charged to customers than direct ordering

- Delivery fees 150-200% higher than direct channels

- Costs from order disputes range from 0.5-2% of revenue

Recent industry data shows these hidden costs can push third-party delivery expenses above 40% of revenue.

Real-life Example: Rs 100 Item Becomes Rs 140 on Zomato

A restaurant owner’s experience shows this pricing gap clearly: “Our hotel’s Rs 100 food item is marked up to Rs 140 in the app. This markup helps us recover the actual menu cost after paying the 28% aggregator charge with tax”.

Customers feel this price increase too. Analysis shows they pay about Rs 46 more per dish through aggregators compared to direct orders. This adds up to at least Rs 12,000 extra yearly for an average household in major cities.

Monthly costs tell a similar story: restaurants might pay Rs 60,000 in aggregator commissions, while direct ordering platforms cost around Rs 3,000 – saving them 95%.

Customer Data and Relationship Ownership

The food delivery ecosystem faces a fierce battle over customer information that shapes how restaurants and platforms work together.

Who Owns the Customer Data?

Food delivery platforms like Zomato controlled customer information through “data masking” by hiding contact details from restaurants. The National Restaurant Association of India (NRAI) challenged this practice and filed complaints with the Competition Commission of India in 2021. Restaurants only receive simple order details while platforms keep valuable customer profiles.

Zomato started testing a new feature in 2023 that lets customers choose to share their phone numbers with restaurants for marketing. This opt-in model marks a big change after years of disagreement between restaurants and delivery platforms.

Impact on Repeat Orders and Loyalty Programs

Customer data ownership plays a key role in retention. The top 5% of restaurant customers generate 28% of total sales. Restaurants without this data find it hard to:

- Spot valuable repeat customers

- Build effective loyalty programs

- Learn about ordering patterns and priorities

- Create tailored experiences

Restaurants using direct ordering systems see a 23% higher customer return rate because they can market directly to customers. This data ownership gap affects profits because finding new customers costs five times more than keeping existing ones.

Zomato’s Limited Data Access vs Direct CRM Tools

Direct ordering systems give restaurants complete control over customer information and better relationship management. These CRM tools offer:

- Full customer contact details for marketing follow-ups

- Complete ordering history to spot priorities

- Tools for targeted promotions based on behavior

- Ways to track customer frequency, recency, and spending

Restaurants on Zomato work without historical behavior data and cannot create direct loyalty programs or tailored offers. Direct communication removes the need for promoted listings in apps, which helps restaurants save on marketing costs.

A restaurant owner put it well: “We serve the food, but we don’t own the customer”. This disconnect shows why data ownership matters as much as commission fees when choosing ordering platforms.

Branding and User Experience Control

The difference between third-party and direct ordering systems goes beyond money and data ownership. Brand identity and customer experience control plays a crucial role.

Zomato Swiggy Logo PNG: Platform Branding Over Restaurant Identity

Restaurants often see their brand identity take a back seat when they partner with aggregators. Food delivery giants Zomato and Swiggy build customer recognition through their distinctive logos – Swiggy’s vibrant orange “S” and Zomato’s deep red emblem. This creates several challenges for restaurants:

- They become just another option among countless competitors

- They lose control over their presentation

- Customer loyalty splits between the restaurant and platform

Brand dilution reaches beyond the app itself. Restaurants display “zomato swiggy logo png” images on their storefronts, menus, and marketing materials, which promotes these platforms instead of their own brand. Some restaurants unknowingly use Zomato-watermarked food photos on Swiggy’s platform, giving free exposure to competitors.

Custom UI and Messaging in Direct Ordering

Direct ordering systems give power back to restaurants so they can create distinctive brand experiences. Businesses can build websites that reflect their unique personality and values through custom-designed ordering interfaces.

Research shows that 72% of diners value individual-specific experiences when ordering directly from restaurants. They appreciate better communication and feel more connected to their favorite establishments. Restaurants that control their user interface can:

- Present their brand consistently everywhere customers see them

- Adapt promotions for local events and holidays

- Create targeted marketing based on customer history

Managing Delivery Quality and Customer Support

Direct ordering lets restaurants retain control over the customer’s entire trip. While delivery quality and timing remain out of restaurant control with aggregators, direct systems allow restaurants to:

- Blend SMS with delivery tracking software for streamlined updates

- Keep immediate communication between restaurant, drivers and customers

- Get valuable feedback through simple SMS surveys

- Solve issues faster through direct communication

NCR Voyix’s 2025 Customer Experience Report reveals that 58% of customers prefer using a restaurant’s app or website to order delivery. Convenience leads at 65%, followed by easier customization at 50%, and loyalty points at 36% as the main reasons.

Profitability and Long-Term Strategy

Restaurant owners are changing faster toward direct ordering solutions in 2025. The numbers paint a clear picture of profitability and strategic planning.

Monthly Cost Comparison: Rs 60,000 vs Rs 3,000

Delivery platforms and owned systems show a stark financial difference. Restaurants using Zomato’s commission-based model spend Rs 60,000 monthly on platform fees. Direct ordering solutions cost just Rs 3,000 monthly—leading to 95% lower operational expenses. These savings amount to thousands annually that restaurants can put back into their business.

ROI of Direct Ordering Systems

Direct ordering systems bring remarkable returns to restaurants:

- 20-60% increase in direct orders

- 30-50% savings on commissions

- 50-100% growth in customer loyalty

Restaurants save 3-5% on food costs through better inventory forecasting. The setup costs range between Rs 250,000-850,000 with monthly subscriptions of Rs 8,000-25,000. Most restaurants see clear returns within 30-90 days.

Hybrid Strategy: Using Zomato for Discovery, Direct for Retention

Smart restaurants now take a dual approach. They use Zomato’s visibility to acquire customers while moving them toward direct channels. Leading restaurants get 20-30% of orders through their direct channels. This balanced strategy lets businesses use the recognizable Zomato Swiggy logo to find new customers without depending solely on aggregators. Restaurants point to three main reasons for this change: “Quality, Control and Profit”.

Comparison Table

| Aspect | Zomato | Direct Ordering |

| Commission Fees | 15-30% per order (up to 35%) | 0% |

| Payment Processing Fees | 2-4% | 2-3% |

| Monthly Operating Costs | ~Rs 60,000 | ~Rs 3,000 |

| Marketing Costs | ₹15,000-30,000 monthly (sponsored listings) ₹25,00,000 per day (homepage takeovers) | Lower costs through owned channels |

| Customer Data Access | Limited access Data masking of customer details | Full access to customer data |

| Customer Return Rate | Lower | 23% higher than platforms |

| Brand Control | Limited (secondary to platform branding) | Complete control over brand identity |

| Price Impact | Item worth Rs 100 marked up to Rs 140 | Original menu prices stay the same |

| Customer Communication | Platform acts as intermediary | Direct communication with customers |

| Setup Investment | No upfront costs | Rs 250,000-850,000 for original setup |

| Monthly Subscription | None | Rs 8,000-25,000 |

| Customer Experience Control | Limited control over delivery and support | Full control over entire customer experience |

Conclusion

The choice between Zomato and direct ordering systems means way more than picking new technology for restaurant owners. Numbers tell a clear story about the financial side. Third-party platforms take 15-30% commission on each order, while restaurants pay nothing with their own ordering systems. A restaurant can save about Rs 57,000 every month by switching to its own platform.

Direct ordering gives restaurants more than just cost savings. They own all their customer data, which leads to 23% more repeat customers compared to third-party platforms. Restaurants also keep complete control of their brand instead of becoming another listing on a delivery app.

The money difference is striking. Restaurants need to price a Rs 100 food item at Rs 140 on delivery apps to keep the same profit after paying commissions. Setting up direct ordering costs money upfront, but most places earn it back in 30-90 days.

Smart restaurants now use both systems. They let Zomato help find new customers while building their own direct channels to keep them. This mix helps them get visibility from big platforms without giving up control or profits.

Customers prefer ordering directly from restaurants. Even with convenient aggregator apps, 68% of people would rather place orders straight with the restaurant. Restaurants that build their own ordering systems in 2025 will have better profits, stronger customer connections, and lasting success.

FAQs

Q1. How much commission does Zomato charge restaurants in 2025?

Zomato typically charges restaurants a commission fee ranging from 15% to 30% of each order value. In some cases, these fees can reach up to 35% when including all fee categories.

Q2. Why are food prices higher on delivery apps compared to restaurants?

Food prices are often higher on delivery apps because restaurants need to account for the high commission fees charged by platforms like Zomato. Additionally, packaging costs and other expenses are factored into the pricing, resulting in menu items being marked up significantly compared to in-restaurant prices.

Q3. What are the benefits of direct ordering systems for restaurants?

Direct ordering systems eliminate commission fees, provide full access to customer data, allow greater control over branding and user experience, and typically result in higher customer retention rates. They also enable restaurants to communicate directly with customers and personalize marketing efforts.

Q4. How do the monthly costs compare between Zomato and direct ordering systems?

Restaurants using Zomato typically spend around Rs 60,000 monthly on platform fees, while direct ordering solutions cost approximately Rs 3,000 monthly – a 95% reduction in operational expenses.

Q5. What strategy are successful restaurants adopting for online ordering?

Many successful restaurants are now employing a hybrid approach. They use platforms like Zomato for customer discovery and visibility, while actively transitioning toward direct ordering channels for customer retention and improved profitability.